Did you know that over 50% of Americans now prefer to apply for loans entirely online? The rise of online lenders has transformed the lending industry, presenting consumers and businesses with a plethora of alternative options beyond traditional bank loans.

In this comprehensive guide, we delve into the realm of online lenders, examining their pivotal features, advantages, and the application process. Whether you seek a personal loan, business financing, or other digital borrowing solutions, this guide will arm you with the necessary knowledge to make informed decisions. It navigates the ever-evolving landscape of online lending, equipping you to make the most of the available options.

Key Takeaways

- Online lenders provide a convenient and efficient alternative to traditional bank loans

- Digital borrowing offers faster application processes and competitive interest rates

- A wide variety of loan types are available through online lending platforms

- Researching lender reputation and comparing loan offers is crucial when choosing an online lender

- Understanding the application process and required documents can help ensure a smooth borrowing experience

What Are Online Lenders?

In the rapidly evolving world of finance, fintech lending and non-bank lenders have emerged as innovative finance providers, revolutionising access to credit for individuals and businesses. These online lenders utilise advanced technology and data-driven algorithms, offering a streamlined and efficient borrowing experience. This contrasts sharply with traditional financial institutions.

Definition and Overview

Online lenders are digital financial platforms that provide a range of lending services, including personal loans, business loans, and even student loans, entirely through online channels. Unlike conventional banks, these innovative finance providers operate without physical branches. They leverage the power of the internet to reach a wider customer base and streamline the lending process.

Key Differences from Traditional Lenders

The primary distinction between online lenders and traditional financial institutions lies in their approach to the lending process. Online lenders offer a more efficient and user-friendly application experience, with faster approval times and a greater emphasis on customer convenience. Additionally, these non-bank lenders often utilise alternative data sources and advanced analytics to assess creditworthiness. This opens up access to credit for borrowers who may not meet the strict criteria of traditional lenders.

The rise of fintech lending has introduced greater transparency and flexibility into the lending landscape. Online lenders often provide more competitive interest rates and a wider range of loan products to cater to diverse financial needs.

Benefits of Using Online Lenders

In the current digital epoch, online lenders have surfaced as a compelling substitute to conventional financial entities. These platforms, facilitating peer-to-peer lending and aggregating online loan marketplaces, proffer numerous advantages, thereby gaining widespread acceptance amongst borrowers. An examination of the pivotal benefits of opting for online lenders is warranted.

Fast and Convenient Application Process

The primary advantage of online lenders lies in their streamlined application process. Securing a loan through an online platform can be accomplished in mere minutes, thanks to the digitalisation of the entire procedure. Applicants can submit their applications and requisite documents electronically, obviating the necessity for physical documentation and in-person interactions at banks or lending offices.

Competitive Interest Rates

Online lenders frequently possess the capability to offer more competitive interest rates compared to their traditional counterparts. By harnessing technology and maintaining lower operational costs, these platforms are able to transfer the resultant savings to their clientele. This can lead to substantial cost reductions for borrowers, rendering online lending an appealing option for those in pursuit of economical financing.

Access to a Variety of Loan Types

The digital lending sphere has broadened the spectrum of loan options available to consumers and small enterprises. Beyond traditional personal loans, online lenders may present a plethora of loan varieties, encompassing business loans, student loans, and even crowdfunding loans. This expansive array of offerings empowers borrowers to identify the most suitable financing solution for their particular requirements.

Whether your objective is to consolidate debt, finance a new business endeavour, or support your educational pursuits, online lenders offer a convenient and economical alternative to traditional borrowing avenues. By comprehending the advantages of this innovative lending paradigm, you can make an informed choice regarding the optimal financing solution for your fiscal objectives.

How to Choose the Right Online Lender

In the rapidly evolving world of digital borrowing, selecting the right online lender can be a critical decision. Whether you’re seeking a personal loan, a business loan, or any other type of financing, it’s essential to thoroughly research lender reputations, compare loan offers, and understand the associated terms and conditions.

Researching Lender Reputation

Begin your search by exploring the online presence and customer reviews of various alternative lending platforms and digital loan providers. Look for lenders with a strong track record of reliability, transparency, and excellent customer service. Reputable online lenders should have a well-designed website, clear policies, and a positive reputation among previous borrowers.

Comparing Loan Offers

- When evaluating loan offers, pay close attention to the interest rates, fees, and repayment terms. Compare offers from multiple lenders to ensure you’re getting the best deal that aligns with your financial needs and goals.

- Consider the flexibility of the loan, such as the option to make extra payments or refinance in the future.

- Assess the lender’s eligibility criteria and whether you meet the requirements for the desired loan amount and type.

Understanding Terms and Conditions

Carefully review the fine print of any loan agreement before signing. Ensure you fully comprehend the interest rates, repayment schedule, penalties for late or missed payments, and any other relevant terms. This will help you make an informed decision and avoid any unexpected fees or surprises down the line.

By following these steps, you can navigate the digital lending landscape with confidence and find the right online lender to meet your borrowing needs. Remember, thorough research and a clear understanding of the terms and conditions are key to a successful and stress-free borrowing experience.

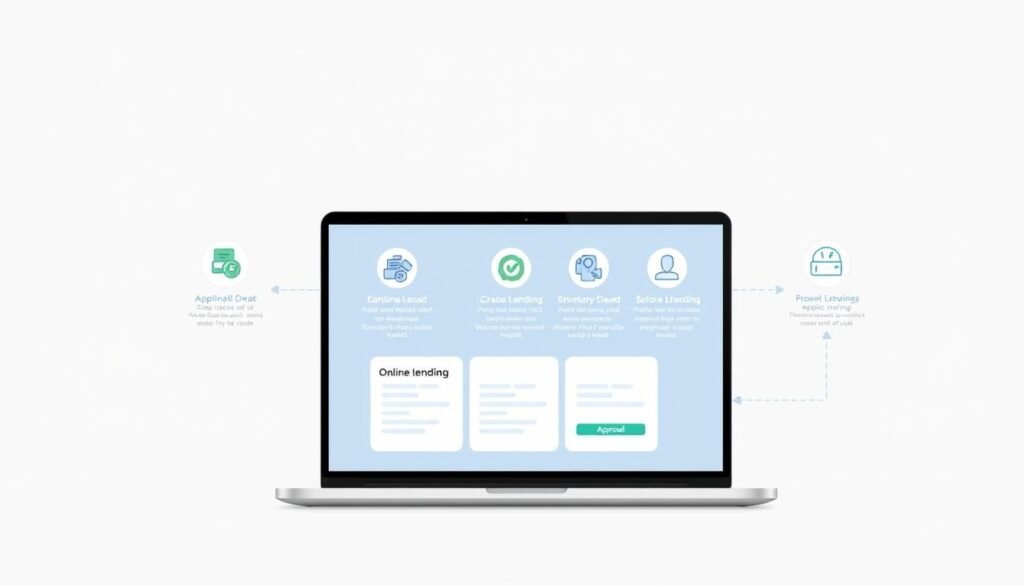

The Application Process Explained

The advent of fintech lending has revolutionised the loan application process, rendering it both streamlined and efficient. Whether your requirement pertains to personal, business, or any other form of financing, the journey is meticulously crafted to be both straightforward and user-friendly.

Step-by-Step Guide to Applying

- Initial steps involve a thorough assessment of your borrowing requirements, followed by a comprehensive research phase to identify suitable online lenders offering the desired loan type.

- Subsequent to this, compilation of essential documentation is imperative, encompassing proof of income, identification, and any loan-specific requirements.

- The subsequent phase entails the completion of an online application form, a task that necessitates meticulous attention to detail and unwavering honesty in your responses.

- Following this, submission of the application, accompanied by any requisite supporting documents, is a critical step in the process.

- The final stage involves a period of anticipation as the lender reviews and approves your application, a process that is significantly expedited by the advanced functionalities of online lending platforms.

Common Documents Required

- Personal identification, such as a driver’s licence or passport

- Proof of income, including pay stubs, tax returns, or bank statements

- Information about your existing debts, if applicable

- Details about the purpose of the loan, such as a business plan or invoice for a specific purchase

What to Expect After Submission

Upon submission of your online loan application, the lender embarks on a meticulous review of your provided information, evaluating your creditworthiness. This evaluation is often automated, leveraging sophisticated algorithms and data analysis to expedite the decision-making process. In the event of approval, the funds are typically disbursed within a few business days, facilitating immediate access to the necessary financing.

Types of Loans Offered by Online Lenders

In the realm of contemporary finance, online lenders have transformed the paradigm of credit accessibility. These innovative finance providers present a plethora of loan products, addressing a broad spectrum of requirements. An examination of the principal loan categories accessible through these online platforms is warranted.

Personal Loans

Personal loans from online lenders are a preferred option for those in need of funds for various purposes, including debt consolidation, home renovations, or unforeseen expenses. Characterised by competitive interest rates and adaptable repayment schedules, these loans emerge as a compelling choice for numerous borrowers.

Business Loans

Small and medium-sized enterprises can significantly benefit from the offerings of online lenders. These entities provide business loans, facilitating entrepreneurs and business proprietors in financing expansion, operational enhancement, or addressing cash flow impediments.

Student Loans

The challenge of financing higher education is alleviated by online lenders. Student loans from these platforms assist in covering tuition fees, living costs, and other educational expenditures, offering flexible repayment plans tailored to the unique circumstances of students.

Home Equity Loans

Homeowners seeking to leverage their property’s equity can rely on online lenders for home equity loans. These loans enable borrowers to access their property’s equity, providing funds for home enhancements, debt consolidation, or other financial objectives. The application process is streamlined and accessible through these online platforms.

The proliferation of online loan marketplaces has broadened access to a diverse array of loan products. This development empowers individuals and businesses to acquire the financial resources they necessitate with enhanced ease and convenience.

The Importance of Credit Scores

In the realm of alternative lending platforms and traditional non-bank lenders, credit scores emerge as a pivotal factor. This numerical indicator, encapsulating your creditworthiness, significantly influences the loan options and terms you are eligible for.

How Credit Scores Affect Your Loan Options

Lenders’ reliance on your credit score is paramount, as it directly correlates with the perceived risk of lending to you. A superior credit score often facilitates access to more advantageous loan terms, including reduced interest rates and more flexible repayment schedules. Conversely, a subpar credit score may severely restrict your loan options or necessitate less favourable conditions.

Tips for Improving Your Credit Score

To enhance your credit score, several strategies can be employed:

- Regularly review your credit report for inaccuracies and dispute any discrepancies.

- Ensure timely payment of all loans and bills to maintain a pristine payment history.

- Adhere to a prudent credit card usage policy, keeping balances low relative to credit limits.

- Exercise caution in applying for new credit to minimise hard credit inquiries.

- Consider becoming an authorised user on a credit card with a proven, positive history.

By grasping the significance of credit scores and actively endeavouring to enhance yours, you can significantly bolster your prospects for securing advantageous loan terms from both alternative lending platforms and non-bank lenders.

Potential Risks of Online Lending

The advent of digital loan providers and online lenders has introduced a new paradigm in borrowing, one that is both convenient and efficient. However, it is imperative to acknowledge the potential risks inherent in this method of lending. Specifically, concerns arise regarding scams and fraudulent lenders, as well as the presence of hidden fees and costs.

Scams and Fraudulent Lenders

The proliferation of online lending has inadvertently created an environment conducive to scams and fraudulent activities. Scammers, masquerading as legitimate digital loan providers, employ various tactics to deceive and exploit unsuspecting borrowers. It is of paramount importance to conduct exhaustive research on any online lender before divulging personal or financial information.

Hidden Fees and Costs

When engaging with an online lender, it is crucial to scrutinize the fine print to comprehend all associated fees and costs. Some digital loan providers may attempt to conceal certain charges, such as origination fees, prepayment penalties, or unexpected administrative fees. Borrowers must diligently compare offers from multiple online lenders to ensure they are securing the most advantageous terms.

To mitigate these risks, borrowers are advised to invest time in researching potential digital loan providers, perusing reviews, and comprehensively understanding the terms and conditions of any loan offer. By exercising due diligence and making informed decisions, borrowers can confidently navigate the realm of online lending and secure the necessary financing.

Frequently Asked Questions about Online Lending

In the realm of peer-to-peer lending and fintech lending, the landscape is in a state of perpetual transformation. This necessitates a thorough examination of the myriad inquiries that borrowers harbour regarding the online lending paradigm. In this discourse, we shall delve into some of the most prevalent enigmas surrounding this burgeoning field.

What is a Prequalification?

A prequalification serves as an initial gauge of your creditworthiness and potential borrowing capacity. It affords you an insight into the loan sums and interest rates you might qualify for, sans the detrimental impact of a hard credit inquiry on your credit score. This preliminary step can be instrumental in navigating the online lending terrain.

How Long Does Funding Take?

The swiftness of the funding process is a hallmark of online lending. Typically, borrowers can access their funds within a few business days post-application submission. Nonetheless, the duration can fluctuate based on the lender’s protocols and the intricacy of your application.

Can I Get Approved with Bad Credit?

- Many online lenders exhibit a more accommodating stance towards borrowers with less-than-ideal credit histories.

- Credit scores, while crucial, are not the sole determinant; online lenders often scrutinise a more comprehensive array of financial data to gauge creditworthiness.

- For those with bad credit, the options might be constrained, yet it remains prudent to explore online lending as a viable avenue.

The domain of online lending is in a state of continuous flux. To uncover the most suitable solution for your fiscal requirements, it is imperative to conduct exhaustive research and juxtapose various lender offerings.

The Future of Online Lending

Advancements in technology herald a transformative era for online lending, with innovative finance providers at the forefront. They are leveraging cutting-edge technologies, including artificial intelligence and blockchain, to revolutionise the accessibility and management of loans. This evolution promises to redefine the landscape of digital borrowing.

Emerging Trends in Digital Borrowing

The ascendance of crowdfunding loans marks a pivotal shift in the future of online lending. This paradigm shift enables borrowers to tap into a broader spectrum of funding sources, often at more advantageous rates. Crowdfunding platforms are thus redefining the traditional lending paradigm, offering a more inclusive and competitive financial environment.

The Impact of Technology on Lender Services

Technology’s influence on the financial sector is profound, prompting online lenders to rapidly evolve their services. Artificial intelligence is being seamlessly integrated into the lending process, facilitating expedited and precise credit evaluations, alongside tailored loan proposals. Blockchain technology, meanwhile, is being explored to bolster the security and transparency of digital transactions, thereby enhancing the overall borrowing experience.